Basically I submitted my tax return on e-filing. For the sake of brevity I will try to avoid all the usual sarcastic comments. You know my views on tax by now. Thereafter, the assessment is created and, lo and behold, the system has determined that I owe the state a certain amount of currency.

Being the dutiful citizen that I am, I set about paying.

Now I bank with ABSA. For the sake of brevity I will try to avoid all the usual sarcastic comments. You know my views on ABSA by now.

So, how do I go about making the payment to SARS from my ABSA account?

Suffice it to say, it was a mission.

- Direct EFT

I tried direct EFT by creating an ABSA beneficiary....but that failed because SARS is one of the "listed" ABSA beneficiaries, which means you have to choose them from a drop-down list on ABSA internet banking and they then pre-populate most of the normal beneficiary fields.

From the listed group, I found one called "SARS ASSESSED TAX - ITA". That looked pretty promising considering my tax assessment also had the letters "ITA" in it. Selecting this beneficiary pre-populates the fields "Institution Code" as "0090027" and Bank Accout Number as "N/A".

Then it gives you fields for you to fill in-

- Account number at SARS ASSESSED TAX - ITA

- Account holder's name at SARS ASSESSED TAX - IT

I deduce this because I filled in those two fields above with my tax reference number from SARS and my name... which seemed logical... but on the last step of adding the beneficiary I get the error "013-Enter a valid beneficiary account number". But ABSA themselves decided that the account number is N/A??? Go figure.

- Credit Push

Amazingly, this worked. Not first time, mind you, but fine in the end.

- So here it is-

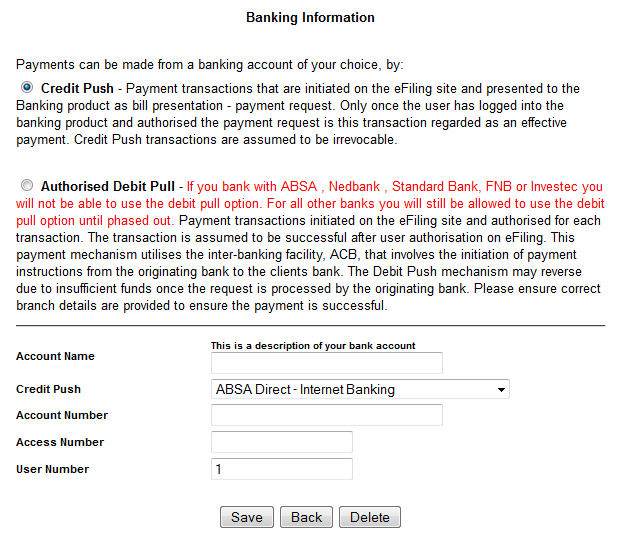

Basically, on the SARS efiling site, you first need to setup your bank account - the one you're going to pay from.

The trick is what to put in the fields

- Account Name: Put your own description here. Makes sense to use the same description you have on the account on your ABSA internet banking profile.

Credit Push: I chose "ABSA Direct - Internet Banking". Seemed to work.

Account Number: This is the ABSA bank account number from which you wish to pay.

Access Number: This is the key - the "login" number you use when you log into ABSA internet banking. Usually this an ABSA bank account number as well but may well not be the one you are paying from!

User Number: Usually 1 but it is possible to have multiple profiles on ABSA internet banking. I don't have this so I can't advise. I left it at 1. Presumably it is the same as what you fill in when you log into ABSA.

Once you've set up the account, you then go to your assessment (IT34 or whatever) on the SARS site and choose to make payment. Choose credit push and then the bank account from the drop-down. The bank account you setup above should be there.

The rest is fairly self explanatory. It should end with a message to the effect that a payment instruction had been created.

Now... on the ABSA side... logon as usual and under payments, go to the bottom - "Authorisations". Choose the "Tax/UIF" tab and then you should see the pending authorisation. This could take a minute or two to arrive but you need to do this on the same day you created the request from SARS or it may expire.

You then get the option to choose an account to pay from. I chose the one I setup on SARS E-filing. Weird that you have options here but anyway... then it's just a case of next, next, next until done. Voila.

James

9 comments:

Thank you very much. this helped a lot. I did struggle with he access number with the credit push on the SARS website.

I managed to get the ABSA EFT to work after a couple of attempts. I had previously tried the credit push method but the transaction was rejected/reversed for reasons unknown to me.

It turns out that, when setting up SARS ASSESSED TAX - ITA as a beneficiary, for

Account number at SARS ASSESSED TAX - ITA

you need to put the full 19-digit payment reference number provided by SARS on your return, and not merely your income tax reference number (although the 19 digit number includes your income tax number).

Not at all self-explanatory.

Thats correct

For the ABSA thing to work you need to enter the full number.

Mine was:

xxxxxxxxxxT00000000

the xxx's are my tax number.

Then it worked....

and SARS got their hard earned cash.

Many thanks for your excellent comprehensive instructions - would never have managed without them!!!

Thanks for this - I had the same struggles. Couldn't set up an ABSA beneficiary (invalid acc number), and didn't want to type my access number/pin into the Direct Payment option.

Despite having used several international banking sites for many years, and trying to find any payment how-to info details on ABSA's and SARS's, it was your blog post which finally explained it.

You could show the government departments and several banks, with their large teams, how it should be done :-).

THANK YOU!!!

Was struggeling with this!

Thanks so much

as you say the Access number is the key as it is the same as your bank account number. No help on SARS website about this

Thank you Steven Dovey, I finally made payment after entering the whole number.

Took 7 years. LOL

that post was in 2015

Post a Comment